Choosing a Plan

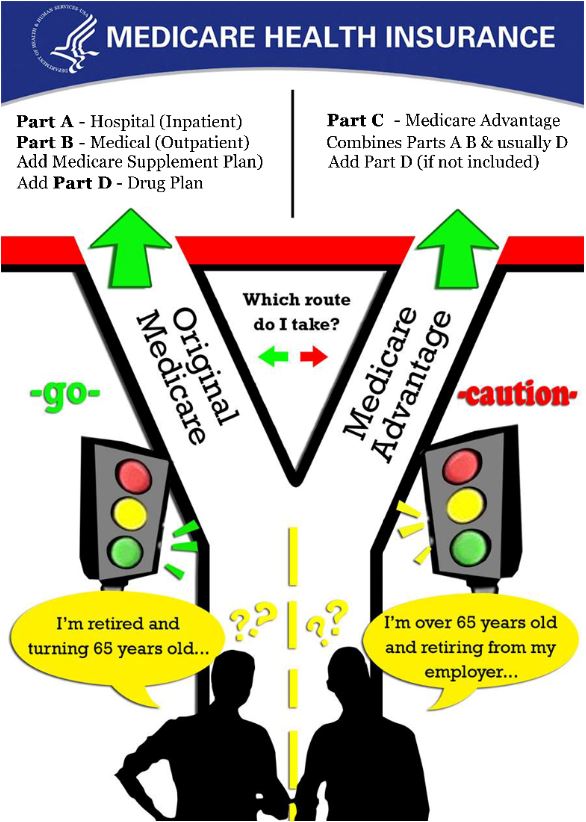

Choosing a Medicare plan that suits your needs and budget isn’t the easiest task. Because there are so many plans to choose from, it can be hard to decipher which one will provide the coverage needed.

That’s why working with an experienced Medicare agent, such as the ones with Great Nation Insurance, can help you compare coverage and rates so you can make an educated and well-informed decision.