Supplement Plan Comparison

A Medicare Supplement (Medigap) plan is a health insurance policy that helps cover the cost of Medicare. When comparing Medigap plans, it is crucial to note that the federal government decides what basic medical benefits each Medicare Supplement plan offers, so coverage stays the same across all carriers.

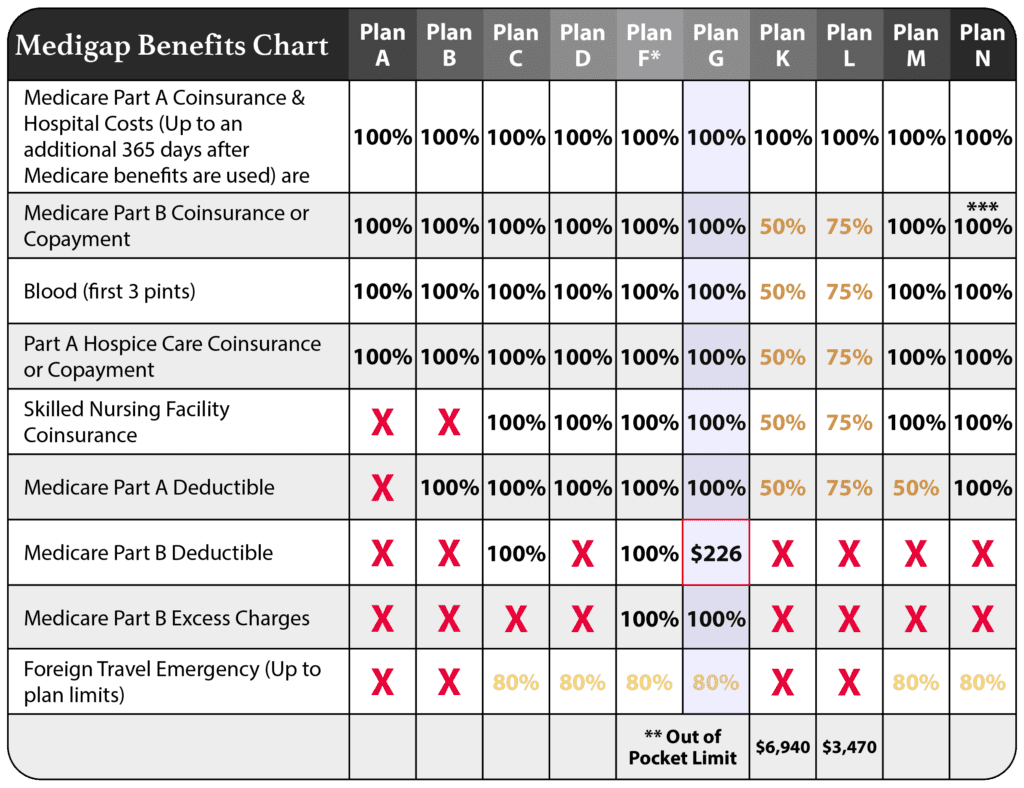

There are 10 types of Medicare Supplement plans available in most states, and each plan is identified by the letters A, B, C, D, F, G, K, L, M, and N, and they are labeled to correspond with a certain level of benefit.