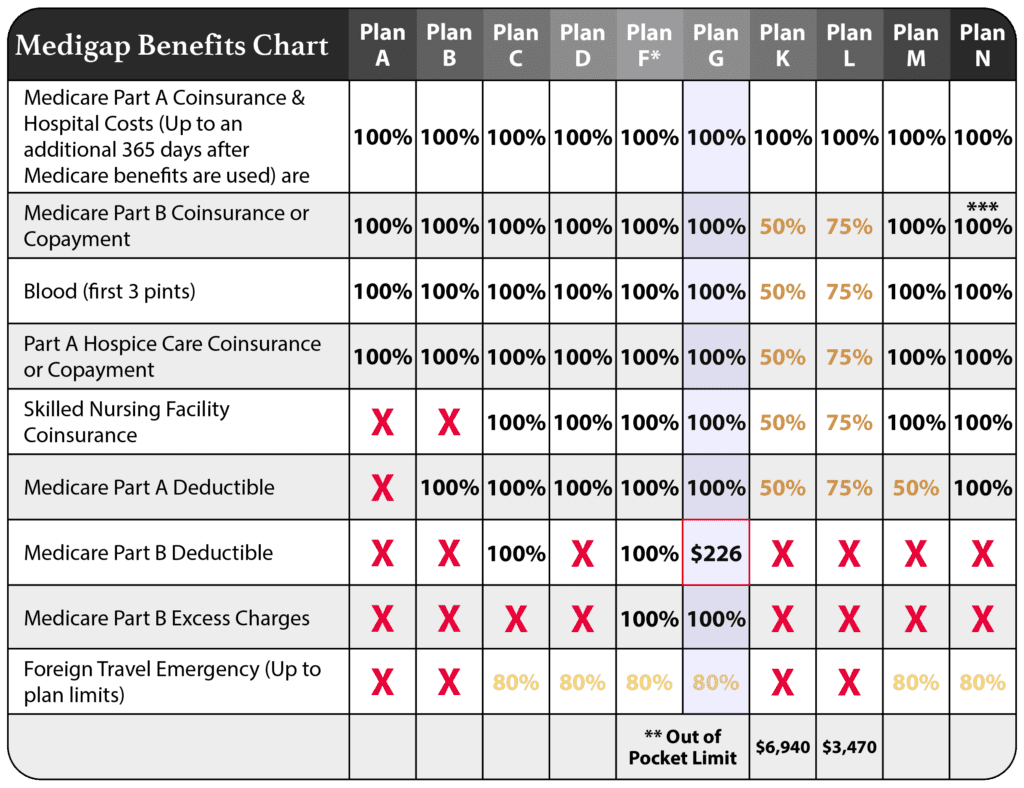

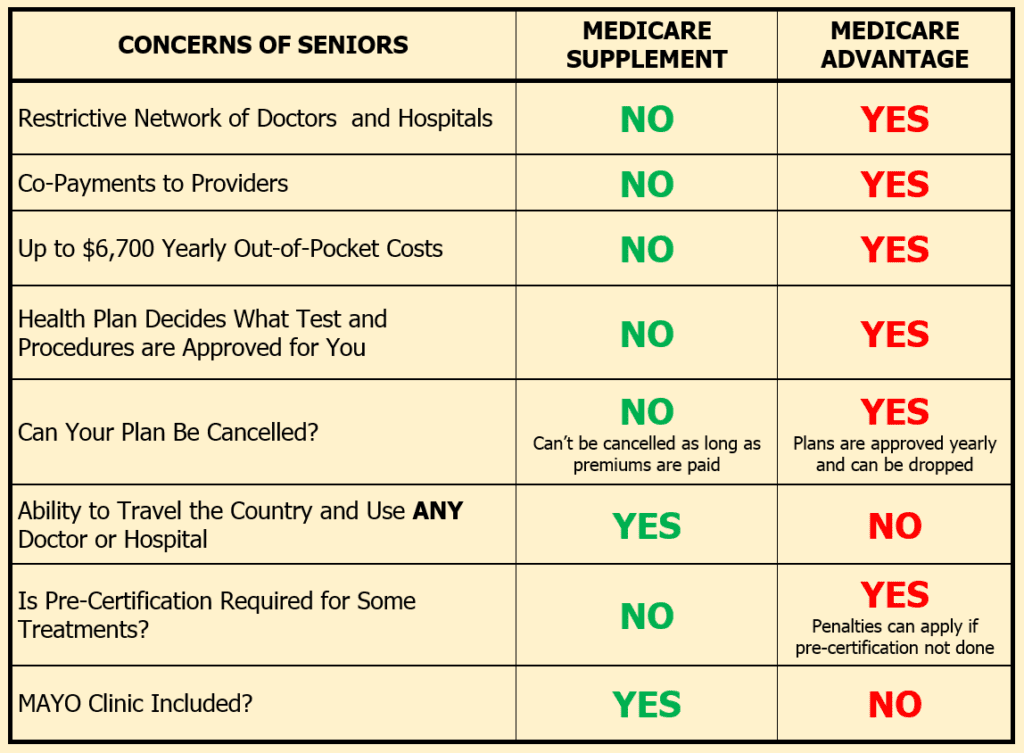

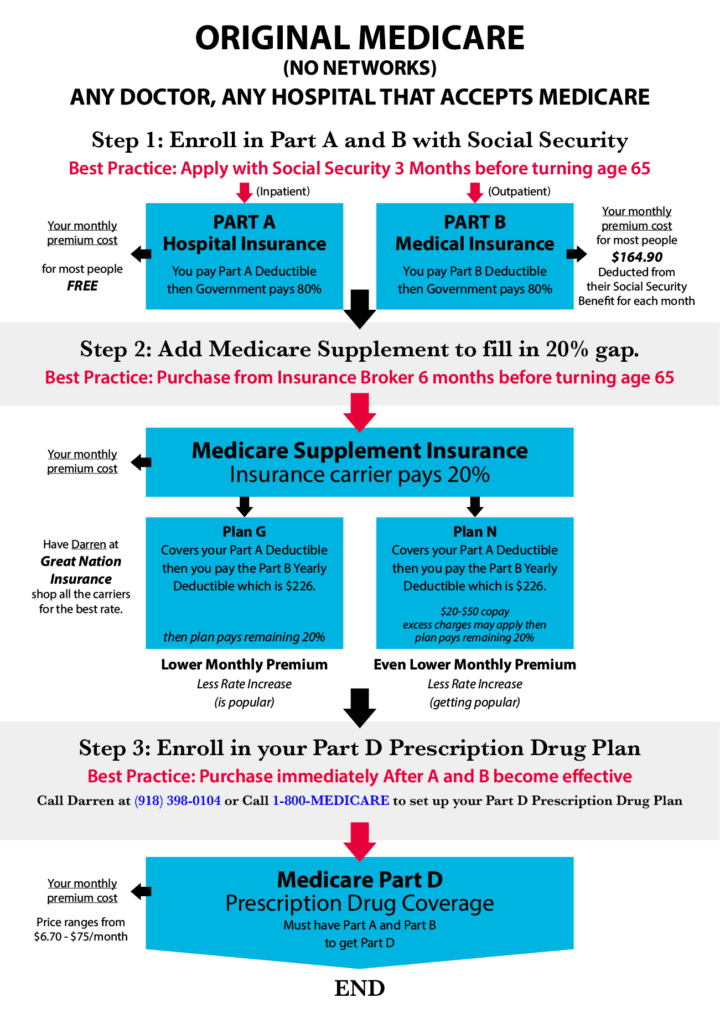

Medicare Supplement is a type of healthcare insurance policy that helps pay some of the out-of-pocket costs not provided by Medicare. Since Medicare doesn’t cover all of the medical expenses, many beneficiaries decide to purchase a Medicare Supplement plan, also known as Medigap, to cover the expenses left behind by Medicare.

These Medical expenses are generally 20 percent of physical therapy, ER, doctor visits, diagnostic tests, and other expenses.